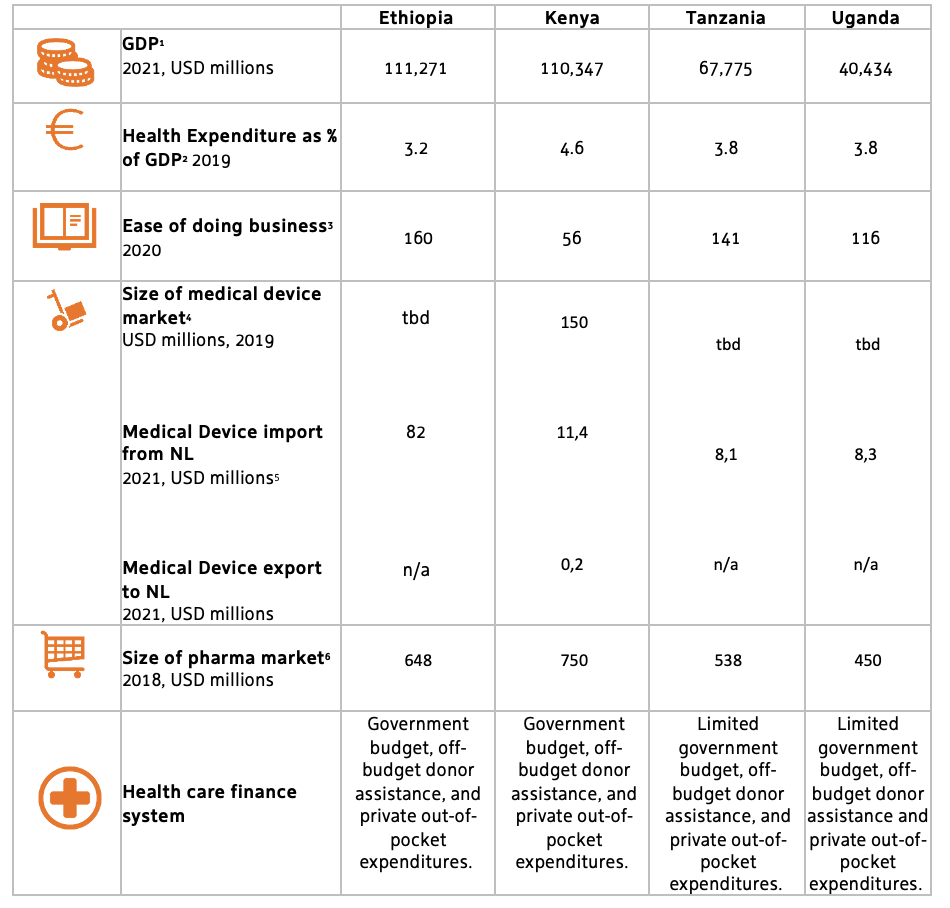

East Africa in the scope of this factsheet refers to the East African nations of Ethiopia, Kenya, Tanzania, and Uganda. These four countries show strong economic growth and have strong commitments to achieve and strengthen universal health coverage.

All East African countries are facing a triple burden of disease, consisting of communicable diseases (like HIV/Aids, TB and malaria), reproductive health related diseases, and a growing prevalence of non-communicable, lifestyle related diseases that are typically associated with a growing middle class. The health systems are characterised by a historically underfunded public sector, growing private sector operators, a faith-based health sector, and large differences between healthcare provision between urban and rural areas. Shared challenges relate to inadequate resource availability and public financing, insufficient health infrastructures and outreach to rural communities, limited medical supplies, and shortages of skilled health professionals. Shared opportunities relate to public policies and investments to address these changes and work towards Universal Health Coverage (UHC), including a focus on digitalisation, a growing private sector and commitments to Official Development Assistance (ODA). Roughly 30% of health financing stems from ODA (Kenya: 21%, Ethiopia: 25%, Tanzania: 41%, Uganda: 41%). The COVID-19 pandemic has exposed and reaffirmed the historical gaps that exist in the health sector. This has resulted in some level of increased focus and investment in the sector by government.

Research and innovation

The following key topics in the field or research and innovation emerge in East Africa:

- Biomedical & Epidemiological Research: Research on AMR, TB, HIV/Aids, One Health, cardiovascular diseases, cancer, diabetes, lung, and neglected diseases.

- Health System Management: Research towards Health Policy, Laws & Regulations, Economics, Financing & Insurance, Health Technology Assessment (HTA), and Health Service Management & Organisation, especially in the field of efficient referral systems.

- Digital Health: Research & Development for innovative health financing, health data management, and smart diagnostics.

Invest

NFIA /Invest in Holland network will not proactively work on acquisition in the LSH sector in East and South Africa. Reactively, the NFIA / Invest in Holland network is keen to welcome and assist foreign companies that contribute to the goal of the Netherlands in finding solutions that deliver better, affordable and sustainable healthcare and strengthen our Life Sciences & health ecosystems.

Regional priorities

Kenya is widely regarded as the economic and innovation hub of East Africa. Kenya’s health sector value is USD 4.5 billion and contributes approximately 5.2% to the country’s GDP. The sector faces enormous deficiencies in coverage and infrastructure, with the government spending being below most of other countries in the region while cost per capita being above of these countries. Private sector contribution is also below that of comparable economies. Together with the economy, Kenya’s middle class is growing and the demand for quality healthcare is on the rise. Kenya’s health care faces a triple transition challenge. A demographic transition, where a large number of young people become adults with increased health care costs. An epidemic transition, with an acute increase in chronic care conditions such as cancers and cardiovascular diseases that are costly for the long-term to treat. And a financing transition, in particular, replacing donor funding by innovative financing as a result of being elevated to lower middle-income status. This will require concerted efforts of multiple stakeholders, including private sector, to realise. Currently, the public sector accounts for 42.9% of the healthcare provision, the commercial private sector for 37.8% and faith-based organisations for 19.3%. The main challenges that the private sector faces is inadequate funding, a high poverty line combined with high costs of services, and a shortage of a healthcare workforce.

Ethiopia[3]

With 109 million inhabitants, Ethiopia is the most populated country in East Africa. The population of Ethiopia is largely rural (79%) and impoverished with limited access to healthcare, as well as other social goods and services that impact health such as housing, water, food and sanitation. System-wide reforms have been made in the heath sector since 2004. As a result, the Ethiopian health sector has made significant progress to improve Ethiopia’s health indicators, which has translated into saving millions of lives. Neonatal disorders and infectious diseases are still causing the most deaths. Although on the rise, the health expenditure per capita lags behind the other East African countries. Moreover, poor infrastructure remains making it difficult for the population to access health services. As required by the national policy on devolution, power is decentralised in the public health sector of Ethiopia. Estimates show that the public sector covers 80% and the private sector 20% of the health market. Ethiopia has free healthcare for all in the public sector. However, there are not enough hospitals to serve the population. Investment opportunities are mainly in the pharmaceutical manufacturing, medical tourism and investments in tertiary care.

With the Health Sector Strategic Plan (HSSP) IV 2015-2020, the Tanzanian government attempted to expand healthcare coverage to all regions of the country within a decentralised framework. The total investments fall short of the estimated minimum financial requirements to provide basic health services to the population. However, health outcomes in Tanzania are better than might be expected given the low expenditure on health, endemic diseases and a large rural population. The HSSP IV The private sector contributes to 53.6% of the health services provided while the public sector accounts for 46.4%. FBOs are the second largest provider of health services in the country, taking up 23.3% of health infrastructure, while the state owns 60%. However, 41.1% of hospitals are owned by FBOs while 40% are owned by the state, making FBOs the largest providers of hospital services in the country. The HSSP has resulted in vast improvements in combating the country’s healthcare challenges. There is limited local production of pharmaceuticals and medical devices in Tanzania, which means that the surplus is imported. The pharmaceutical market is growing, mainly generic medicines, and the imports of those are increasing. Tanzania adoption of a Digital Health Investment Roadmap for 2017-2023 and Digital Health Strategy for 2019-2024 indicate the focus on ICT in public health services delivery.

In Uganda, over half of the population is under the age of 18. This makes that the country has one of the youngest populations in the world, and one of the most rapidly growing. Across Uganda, both public and private sub-sector players provide health services to the people of Uganda. According to the Ministry of Health, the government contributes about 66% of the service delivery outlets. Private health providers comprise Private Not-for-profit organisations (PNFPs), private-for-profit health care providers (PFPs) also known ascommercial health care providers, accounting for 34% of the service delivery, and traditional and complementary medicine practitioners (TCMPs). Nearly 70% of the facility-based PNFP organisations exist under faith-based umbrella organisations. Public expenditure on health is relatively low. Development partners (~40%) and household out-of-pocket spending (~40%) remain to contribute for the largest shares of health expenditure. Uganda is slowly moving towards achieving universal health coverage (UHC). The country has a robust health sector development plan that aims to accelerate movement towards UHC with essential health and related services needed for promotion of a healthy and productive life. This is part of the overall targets of the country’s Vision 2040. The private sector is becoming more integrated in public policy and it is envisioned that it should play an important role to achieve UHC in Uganda.

[1] Embassy of the Kingdom of the Netherlands in Nairobi, 2020 November

[2] Africa Health Business Ltd., 2021, Kenya's Health Sector: Snapshot

[3] Africa Health Business Ltd., 2019, Ethiopia’s Health Sector: Snapshot

[4] UNICEF, 2018, Tanzania: Health Budget Brief 2018. www.unicef.org/esa/media/2331/file/UNICEF-Tanzania-Mainland-2018-Health-Budget-Brief-revised.pdf.pdf

[6] www.mediceastafrica.com/content/dam/Informa/mediceastafrica/2019/downloads/healthcare-market-insights-uganda.pdf

[7] Global Financing Facility, 2017, Exploring Partnership Opportunities to achieve Universal Health Coverage. www.globalfinancingfacility.org/sites/gff_new/files/Uganda-Private-Sector-Assessment-health.pdf

[8] Africa Health Business Ltd., 2021, Uganda's Health Sector: Snapshot

Task Force Health Care has identified 132 unique organisations that are active or interested in East Africa. This list includes 93 SMEs, 15 NGOs, 9 Multinationals, 13 Knowledge institutes, 1 development bank, and 1 health insurance company.

Most prominent NL value chains

Trade

1. The Digital Transformation of Health and Care: Dutch organisations that develop and deliver IT solutions for Health Information Management Systems, Health Financing, Health Behaviour, Telehealth & Mobile Health (health from a distance), Disease management platforms, Electronic Health Records, Training & Education, and artificial intelligence to support medical decision-making.

- Opportunities: Growing attention, policy initiatives and investments in the field of digitalisation for improving quality and access to healthcare, also to reach out to more rural areas.

- Barriers: Lack of legal frameworks for IT solutions, inadequate financial resources, lack of user acceptance, difficult to reach key decision makers.

- Preferred countries by sector: Kenya

2. Accessible Medical Technology for Sustainable Health and Care: Dutch organisations that produce, assemble and deliver medical devices, supplies and/or supply packages (medical kits) for diagnostics, treatments and/or rehabilitation, either high-tech or specifically designed or tailored for low resources settings (point of care).

- Opportunities: Growing private health sectors, which tend to source for quality (Western branded) and cost-efficient solutions for more advanced devices. Faith-based and public health sectors which cater for a large part of the population.

- Barriers: Price-based market. Lead times tend be longer due to bureaucracy, in-transparent decision-making processes in the public sector. Difficult to reach key decision makers. Weak(er) regulatory environment and institutions for justice.

- Preferred countries by sector: Kenya, Ethiopia, Tanzania, Uganda

3. Infrastructure: Dutch organisations that are able to develop and execute turn-key hospital and clinic projects that include project finance, build, equipment, train and operate. Both brownfield and greenfield projects.

- Potential opportunities: General need for health infrastructure. Growing private health sector.

- Barriers: International competition, including consortia from countries that can bring attractive financing solutions. Difficult to reach key decision makers.

- Preferred countries by sector: Kenya, Uganda, Tanzania, Ethiopia

4. Public Health: Dutch organisations that have expertise and solutions for Primary & Community-level models & interventions (mother & child), Sexual and Reproductive Health & Rights (SRHR), Health system data management (digital platforms for data collection, assimilation, interpretation), Health Policy, Financing/Payments, Monitoring & Evaluation, Procurement & Supply Chain Management, Epidemiology/infectious diseases (prevent, screening, control programmes), and Training & Education (vocational, university, postdoc, including research education).

- Opportunities: Under the umbrella of UHC a growing attention for primary & community-level models and interventions, international donor grants.

- Barriers: International competition, including consortia from countries that can bring attractive financing solutions. Limited capabilities for PPP models. Difficult to reach key decision makers.

· Preferred countries by sector: Kenya (to be explored: Ethiopia, Tanzania, Uganda)

Overview milestones & flagships

· G2G (MoU, state visits)

· Trade (PIBs, Market studies)

· Innovate (joint R&D projects, specific bilateral calls)

· Invest (significant investments in the Dutch LSH sector)

Collective Activities to East-Africa

2016

- Market Study Kenya

2017

- Incoming delegation from Kenya (Feb)

- Incoming delegation from Kenya (Sep) for the Health~Holland Visitors Programme & World of Health Care

- Economic Mission to Kenya w/ Vice Minister VWS

2018

- Incoming delegation from Kenya for the Health~Holland Visitors Programme & World of Health Care

2019

- Economic Mission to Kenya & Ethiopia w/ Vice Minister VWS

- Incoming delegation from Kenya for the Health~Holland Visitors Programme & World of Health Care

2020

- Incoming delegates from Kenya & Ethiopia for the virtual edition of the Health~Holland Visitors Programme & World of Health Care

- Health~Holland Digital Meet-up East-Africa

2021

- Update for Market Study Kenya focusing on Medical Devices & eHealth

- Incoming delegates from Kenya for the virtual edition of the Health~Holland Visitors Programme & World of Health Care

2022

- Incoming delegates from Kenya and Ethiopia for the physical edition of the Health~Holland Visitors Programme & World of Health Care in Rotterdam

- Trade Mission to Kenya (Nairobi and Kisumu)

- Health~Holland Financing International Projects Seminar

- Health~Holland Digital Meet-up Kenya and Nigeria

The way forward

Preferred actions

Kenya

- Combination track in Life Sciences and Health

- SDG Hub Nairobi

- Follow-up of contacts obtained in the outgoing trade mission in November 2022.

- Possible health journalists visit to profile Netherlands health sector.

Ethiopia (1), Uganda (2), Tanzania (3)

- Conducting market studies to increase the understanding on developments, opportunities and doing business for (various) Dutch LSH sub-sector(s).

- Follow-up opportunities w/ NL high level officials and matchmaking with local stakeholders, based upon market studies.

East-Africa general

- Investigate and resolve the financial bottlenecks of Dutch entrepreneurs in East Africa.

- A sustainable program or revolving fund to strengthen cooperation in the field of digital transformations and position the Netherlands a trusted and preferred partner.