Switzerland is located on the European continent and surrounded by countries that are a member of the European Union. Switzerland, however, is not a Member State and has bilateral agreements with the European Union instead. Swiss healthcare spending amounts to 11.88% of the GDP, which is the highest of all EU countries and the second highest in the world. Though costs may be high, the Swiss healthcare system delivers good health outcomes. However, it is highly decentralised and fragmented since it is influenced by the federal government and the 26 cantons.

A major reform in Swiss healthcare started with the Health2020 strategy, which included national health priorities, objectives and measures. Important areas within the Health2020 strategy were improving the use of information and eHealth, improving healthcare provision for people with specific needs, and improving outpatient (ambulatory) care planning.

Building on the foundations of Health2020, the Health 2030 strategy was adopted. Its goal is to maintain the population’s very good health status and improve quality of life. People in Switzerland live in an environment that is conducive to health, regardless of their state of health and socioeconomic status. They benefit from a modern and high-quality and financially sustainable health system.

Health2030 focuses on the four most pressing challenges: technological and digital change; demographic and social trends; preserving high-quality and financially sustainable healthcare provision; and positively influencing the determinants of health.

The strategic relation between Switzerland and the Netherlands in the area of LSH is in a starting phase. In the coming years, this relationship will be structurally built up and strengthened.

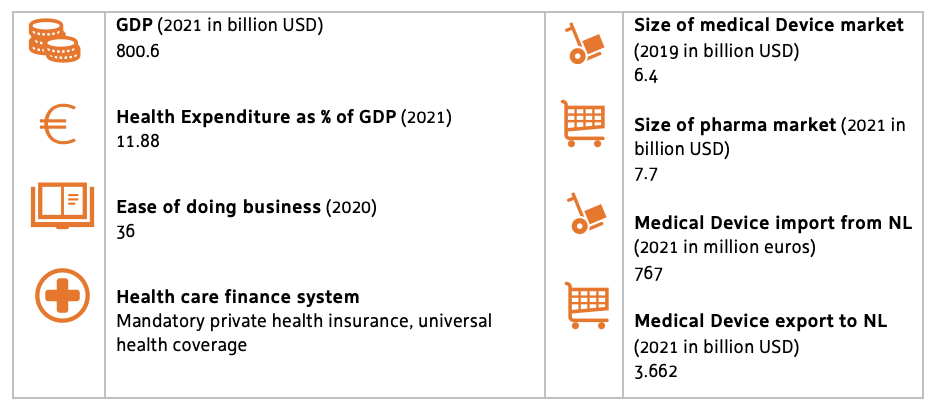

Trade

Care coordination and integration

In recent years, Switzerland has taken measures to contain healthcare costs and combat the projected future shortage of health professionals. This must be achieved through better care coordination and more care integration. Development and introduction of tools that enable the interoperability of health (data) are required. The national Health2030 strategy focuses on integrated health care models. Furthermore, a national cost-containment programme was adopted in 2018, encompassing cost-control, pharmaceuticals, cost transparency and care coordination.

Digitalisation of healthcare

The digitalisation of Swiss healthcare is underdeveloped. Major concerns are related to data protection and security, since the Swiss population and medical professionals are critical3 . Digitalisation is an important pillar in the Swiss national Health2030 strategy. The national programme ‘Strategie eHealth Schweiz 2.0’, rolled out a new electronic patient record system in 2020. This new system will enable improved care coordination, efficiency, quality and safety1. However, the adoption of this new system is still limited.

Ageing society

Like many other western countries, Switzerland faces the consequences of an ageing population. This includes a rising incidence of non-communicable diseases, more pressure on the healthcare system’s resources and higher costs. The biggest expenditure of Swiss healthcare is on chronic diseases. Strengthening disease prevention and health promotion remains a national issue. Switzerland therefore started a National Strategy for Prevention of Non-communicable Diseases in 2018. with the vision: “More people stay healthy or enjoy a high quality of life despite chronic illness. Fewer people contract avoidable non-communicable diseases or die prematurely. Regardless of their socioeconomic status, people are empowered to foster a healthy lifestyle in a healthy environment.” The predecessors were the National dementia strategy, palliative care strategy and cancer strategy.

Innovate

For the past ten years, Switzerland has ranked top of the Global Innovation Index. It is one of Netherland’s partners in life sciences & health research and innovation cooperation. Through diverse modalities (like Horizon Europe, EUREKA/Eurostars, AAL) R&D innovation and technology cooperation between Dutch and Swiss companies, knowledge institutions and governmental services is promoted. Important areas of research and innovation cooperation:

eHealth, health data and health data infrastructure collaborations

Switzerland and the Netherlands see complementarities in the field of digital health and revealed opportunities for collaboration. Both countries invest in community-building and public-private collaborations. Dutch-Swiss collaboration exists on health data infrastructure between Health-RI and Swiss Personalised Health Network (SPHN), (disease area-)specific projects promoting the use of ‘real life’ data and digital technologies, bilateral collaboration on a joint digital health Eureka call (connected to the Dutch-Swiss long-term strategies in public health laid down in The Federal Council’s health policy strategy 2020–2030 and the Dutch Knowledge & Innovation Agenda (KIA) on Health and Care 2020-2023) and collaboration between Smart Health communities in Basel and Amsterdam. There are ambitions for a second Eureka call in 2023.

Biotech pharma & preventative health

Considering the strengths of the Swiss and Dutch biotech ecosystems both have joint ambitions in the field biotech and preventative health. The Netherlands has a dense concentration of biotech clusters, world-class universities and a long history of strategic partnerships between science, industry and government. In Switzerland, the Swiss biotech hub provides over 50,000 jobs and, together with the pharmaceutical and chemical industries, contributes to more than 40 percent of the Swiss exports. Local companies hold leading positions throughout many sectors and attract capital, partnerships and talents from all regions. The basis for this success is a close-knit network between research and development, driven by renowned universities, highly-specialised SMEs and strong multinational corporations. Areas of interest are cardiovascular, oncology, personalised medicine and regenerative medicine.

Connecting Biotech pharma ecosystems

The strategic relation between Switzerland and the Netherlands in the area of LSH is in a starting phase. Ambitions to build the connection between both ecosystems are reiterated. In the coming years, this relationship will be structurally built up and strengthened. That will ultimately facilitate multi-annual programming. A strategic roundtable in March 2023 in Basel is therefore a key ingredient for the further internationalization of the NL LSH sector and the National Growth Fund (NGF) programs. The roundtable will be followed by an in-depth mission program in June or September with key experts (researchers and innovative businesses).

Invest

According to S-GE, Switzerland is home to a globally unique life science cluster. In addition to chemical and pharmaceutical firms like Novartis, Roche, and Syngenta, this encompasses a dense network of MedTech, biotech, and nanotech companies. The life sciences industry in Switzerland has a strong international bias, 98% of its turnover is made abroad. With a share of 33% of Swiss export goods, chemical-pharmaceutical products are the most important exported good in Switzerland. Many high-quality scientists are available in Switzerland thanks to leading universities and universities of applied sciences and financially sound and research-based pharmaceutical companies.

Switzerland is a very interesting market to look at in relation to their unique life science cluster. Many companies from the US has chosen Switzerland for their European Head Quarters and R&D related activities and has chosen the Netherlands for their logistics operations. We do see opportunities to attract more R&D activities from Swiss and this is the reason to jointly participate in activities related to this topic for innovation and trade.

The activities for Switzerland are coordinated from our NFIA / Invest in Holland network office in München and Vienna in collaboration with the Invest in Holland LSH team in The Hague.

Regional priorities

https://www.swisslifesciences.com/swiss/portal/index.php

Major LSH clusters are located in Northwest Switzerland, Geneva (Lausanne) and Zurich.

Northwest Switzerland

Basel is home to the Life Sciences Cluster Basel.

Geneva (Lausanne)

Geneva has a dedicated biotech campus (Campus Biotech Geneva) and the Lausanne life science park Biopôle.

Zurich

The Life Science Zurich Business Network promotes cooperation between the Life Sciences stakeholders in academia, industry and the public sector in the greater Zurich area as well as with other life sciences centres in Switzerland and across the world

Overview of Dutch interest in Switzerland per organisation type:

- Based on Achilles data 1.7% of Dutch companies in Switzerland that are served by the Embassy in Bern are active in the industry Life Sciences & Health (2020), compared with 10% served by the Economic Network in Western Europe as a whole.

Most prominent value chains

- Healthy Living & Ageing ‘Research and solutions that contribute to maintaining (prevention), strengthening and recovering (rehabilitation) physical and mental wellbeing, by increasing people’s independency’. Like Switzerland, life expectancy in the Netherlands is very high while the population is also ageing. Switzerland is home to many hospitals, and patients are generally treated inside hospitals. The Dutch have considerable experience in delivering home care, meaning healthcare outside expensive hospitals. In Switzerland, home care is mostly limited to the elderly. However, in the Netherlands, home care is expanded to all people suffering chronic diseases, physiotherapy and oncological aftercare. The Dutch acknowledge the importance of prevention and healthy lifestyles, which Switzerland needs to combat the consequences of its ageing society. The Dutch achieve this by multidisciplinary collaboration between medical disciplines, thereby fostering integrated care which is a goal of Switzerland. monitor.

- Connected Care: ‘Connecting data, systems, information and persons in a convenient, safe and secure way’. Switzerland is lagging behind when it comes to the digitalisation of healthcare. On the contrary, the Netherlands is a frontrunner considering the adoption of eHealth and IT in healthcare. Compared to Switzerland, the Netherlands has extensive experience in using electronic health records. The Netherlands develops solutions through extensive collaboration and co-creation between government, research institutes, SMEs, multinationals and civil society. One reason for this approach is to take away concerns about data security and privacy, because different stakeholders supervise the development instead of a single organisation. This approach seems suitable to take away the Swiss concerns.

- The Digital Transformation of Health and Care: ‘the use of data for clinical decision making, diagnosis of disease, detection of acute and long-term risks, treatment plans and monitoring’. Since the Netherlands is a frontrunner in digitalisation of healthcare, there is plenty of experience and know-how on collecting, managing, and converting this data. Health data collection in Switzerland is rising since the introduction of the new electronic patient record system in 2020. Switzerland has prepared for this transition and opened a new center for artificial intelligence in medicine in Bern in January 2021.

- Biopharma: Switzerland is home to several well-known big pharmaceutical companies like Roche and Novartis. The pharmaceutical sector is important for the Swiss economy and is developing fast. One major development is personalised medicine, which has drawn attention in both countries. Sophisticated data infrastructure is a requirement for personalised medicine, which is an expertise found in the Netherlands.

- Hospital Design & Construction: Switzerland is home to many hospitals. Despite the Swiss development towards more outpatient care, high-quality hospitals and infrastructure will be needed in the coming years. Merging single hospitals into larger hospitals is a trend seen since 2015, and at the same time, hospitals are becoming more specialized. Since 2013, there has been a strong growth of investments in large public hospitals and a tendency towards more ambulant treatments . The Netherlands have fewer hospitals than Switzerland that serve a population twice as large. The Dutch have experience in creating specialised hospitals, which increase healthcare efficiency, an objective of Swiss health policy reforms.

Overview milestones & flagships

- G2G (MoU, state visits, thematic focus on e.g. prevention, digitalisation)

- Trade (PIBs, Market study, missions, incoming delegations)

- Innovate (joint R&D projects, specific bilateral calls)

- Invest (significant investments in the Dutch LSH sector)

2019

- Market study eHealth: ‘The Digital Health market in the Netherlands and Switzerland’

- 6 December: Healthcare opportunities in Switzerland, seminar in Utrecht

- Networking event with 60 NL-Swiss LSH experts at Roche, Switzerland.

- 3 December 2019: DayOne experts event with Top Sector LSH, Ministry of Health, Welfare and Sport (VWS) and NELL/Leiden University Medical Center.

- 3-4 December Fact finding mission from Top Sector LSH, NFIA / Invest in Holland network, VWS to Novartis, Innovation Attaché, Basel area, University of Basel, University Hospital Basel, Innosuisse, Swiss Ministry of Health, Honorary Consul and Dutch Embassy in Bern.

2020

- 28 January: FutureHealth conference with Nico van Meeteren about the Knowledge and Innovation Agenda and the Electronic Patient Dossier.

- 22 June: Dutch-Swiss LSH virtual workshop about innovation and health data infrastructure, with amongst others, Health-RI, SPHN, University of Basel, Health clusters Basel and Amsterdam.

- July: Preparatory meeting of the visit of Innovation Lab of the University Hospital of Basel to NL.

- During the year: Preparation of Swiss-Dutch EUREKA call with Innosuisse, RVO, Health Holland, Swiss Ministry of Health, Dutch Embassy in Bern.

- 6 December: follow-up of Dutch-Swiss LSH virtual workshop about innovation and health data infrastructure by the Dutch Embassy in Bern.

2021

- 24 February: Information webinar Swiss-Dutch eHealth EUREKA Call.

- 10 March: Swiss HealthValley meets Health Valley NL, with Campus Biotech Geneva/Biopole Lausanne

- 30 March: Swiss-Dutch Learning Hour on Health Data Governance

2022

- 10-12 May: Digital health trade mission to Switzerland

- January / October: Swiss-Dutch Learning Hour on Health Data Governance

2023

- 8 March: Swiss-Dutch Learning Hour on Health Data Governance

- 20 March: Strategic Swiss-Dutch Roundtable on Cell & Gene Therapy

The way forward

Several initiatives will be deployed from 2021 onwards to initiate new relations between Switzerland and the Netherlands in the LSH area. Building a long-lasting relationship between both countries is needed for multi-annual programming.

- Facilitate matchmaking

COVID-19 made it more difficult to get in contact with potential business partners, stakeholders and decision-makers. However, the need to do so still exists and should be facilitated. - Knowledge sharing

Many Dutch organisations are already active in Switzerland. Their experience can benefit the internationalisation of other organisations. Facilitating knowledge sharing among stakeholders will therefore be stimulated. - Building sustainable relationships with Swiss counterparts

Building long-lasting relationships is an integral part of the Health~Holland International Strategy 2020-2023. It is a requirement for the intended multi-annual programming in Switzerland.

|

(Preferred) actions |

Expertise/capacity/finance |

|

Mission to Switzerland focused on digital health |

Privately organised with support of NL Embassy or BDC mission in consultation with TFHC |

|

Participation of Swiss delegation during Health~Holland Visitors Programme & World of Health Care |

H~H, TFHC in cooperation with the Dutch Embassy |

Bridging the Netherlands & Swiss biotech ecosystem

Trends, sector overview & practical tips.