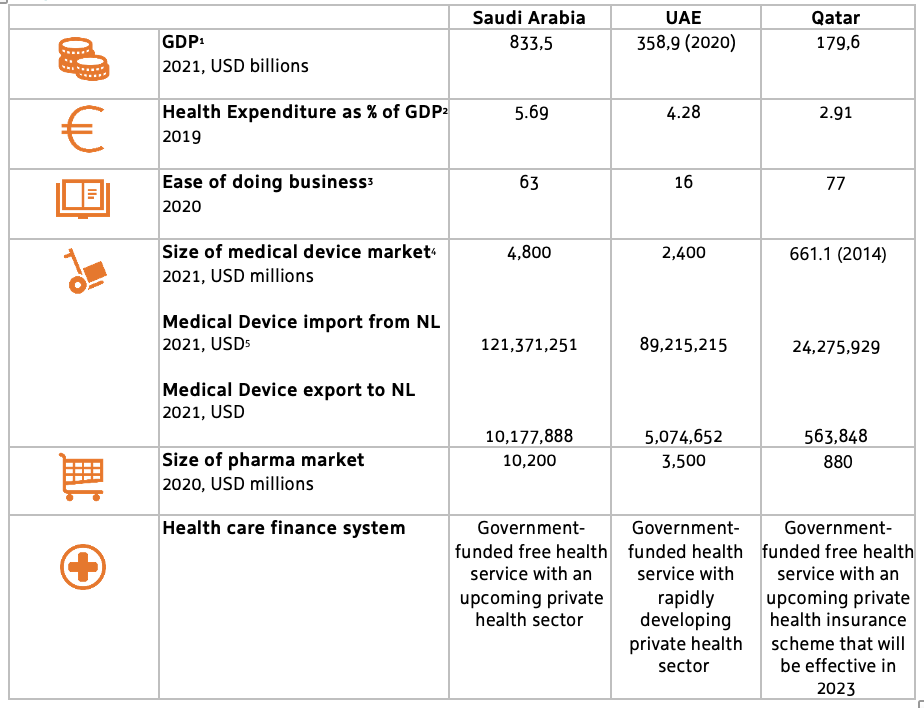

The Gulf Region in the scope of this factsheet refers to Qatar, Saudi Arabia and The United Arab Emirates. These three countries have been prioritising and heavily investing in the healthcare sector, to meet the demands of a growing population and to increase the quality and cost effectiveness of the health system.

The Gulf Cooperation Council healthcare is currently undergoing transformation at an unprecedented pace and scale. The ecosystem is not only moving from curative to preventive care but also adopting a value-based and integrated delivery model.

Supported by positive reforms of regional governments, the LSH sector remains a top priority for the public and private sector. As a result of this, the private sector is growing considerably. Despite the subsequent economic slowdown, regional governments continue to bear a sizeable part of the healthcare expenditure while encouraging private sector participation.

The GCC has been swift in its response to the COVID-19 pandemic with unprecedented measures to mitigate risks. Nevertheless, the crisis has caused considerable headwinds for the sector. At the same time, the pandemic has incentivised service providers to ramp up investments in digitisation in a bid to drive growth and improve operational efficiencies.

GCC’s healthcare services continue to be of high interest to investors due to reasonable returns and sustainable growth opportunities. Amid rising threat from communicable and NCDs, the need for further investments is imperative to bridge the demand-supply gap across the value chain.

Trade

- Hospital Build, design and equipment: Products and services concerning the design, building, furnishing, equipping, operations and maintenance of hospitals and clinics.

- Digital Transformation of the health sector: Products and services within the domains of information- & communication technologies which contribute to the efficiency, effectiveness and digitalisation of the healthcare sector. Telehealth, eHealth, Value Based Health Care, Online patient and healthcare processes management (EHR, Mobile Healthcare Apps), Artificial Intelligence in health

- Public Health: Products and services within the domains education, training, consultancy and advisory services to optimise care capacity.

- Biopharma: The pharmaceutical market is heavily dependent on import. Up to 80% of the total of pharmaceuticals are imported.

- Mobility & Vitality: Products and services in the field of prevention, rehabilitation and home care.

Research & innovate

- Digitalisation & Health technologies

- Healthy Aging

- Research on non-communicable diseases: e.g. cancer and diabetes

Invest

The Netherlands Foreign Investment Agency (NFIA/Invest in Holland network) has a foreign office in Dubai. However we do not see many investment projects within Life Sciences & Health from this region. As the Gulf region is developing its own delivery of healthcare, this does not provide a market to pro-actively target. NFIA/Invest in Holland is open to inform and assist Life Sciences and Health companies from the Gulf region that show interest in expanding to the Netherlands. NFIA / Invest in Holland network will focus on supporting foreign companies that will contribute to the goal of the Netherlands in finding solutions that deliver better, affordable and sustainable healthcare and strengthen our Life Sciences & health ecosystems.

Regional priorities

Qatar

Demography & NCDs: A rise in population to 2.8 million by 2022 will stimulate demand for healthcare services in the country. Qatar citizens are overrepresented when it comes to diabetes, obesity, hypertension, cancer, heart conditions and cardiovascular diseases, as well as other lifestyle-related diseases This, coupled with the size of ageing population, will further augur demand for healthcare services. The long-term nature of chronic diseases conditions is also supporting the increasing demand for health care services and specialised treatment.

Qatar 2030 vision aims to ensure a comprehensive world-class health care system accessible to the whole population, by developing a national health policy, plan public-private partnership projects, focus on research, and build a skilled national workforce. The current National Healthcare Strategy (NHS) 2018-2022 focuses on more preventive and community-based health care to achieve a health system of the highest international standards. The MoPH is currently drafting the new NHS 2022-2026 to be announced in the first quarter of 2023.

COVID-19 increased the use of telemedicine which accelerated acceptance and adoption of eHealth solutions. Qatar has a strong foundation in eHealth and is actively looking for services and products in the eHealth sector. Qatar has a long history of eHealth, there is a dedicated eHealth strategy that is embedded in the National Health Strategy.

Health Insurance: The Qatari Ministry of Public Health introduced a National Health Insurance Scheme to be led by the private sector. A Dutch healthcare consultancy firm was awarded this 3-year project to design and implement the Qatari health insurance scheme. This scheme will be rolled out in phases to Qatari nationals and residents. Over time, this should reduce the burden of health care expenses on the public sector and help ease the pressure on government hospitals by increasing the private sector’s share in national health infrastructure. Increased coverage is additionally likely to drive the health care market.

Privatisation: In order to meet the increasing demand of healthcare services and share the financial burden on state finances, Qatar is set to attract FDIs through Public-Private Partnerships (PPP) initiatives in the healthcare sector. The implementation of Qatar’s compulsory insurance scheme is expected to change the market dynamics from a government-based health provider to an increasingly privatised health care sector. According to BMI Research, private spending is projected to grow than public spending, at an 8.8% compound annual growth rate between 2016 and 2026. The projected need for private health care expenditure will offer opportunities for companies specialising in designing health care facilities, and those offering services or supplying products.

Saudi Arabia

Demography & NCDs: Healthcare needs will continue to rise, as the country’s population aged over 65 will expand exponentially from 2030 onwards. Moreover, NCDs account for approximately 73% of all mortality cases in the Kingdom, with cardiovascular diseases as the leading cause, followed by cancer. Saudi Arabia ranks seventh in the world for age-adjusted prevalence of diabetes. Approximately, 18.7% of the population between the age of 20 and 79 in Saudi Arabia suffer from diabetes and over 40% of the Kingdom’s citizens are considered to be obese. The rise in these lifestyle diseases will support demand for highly specialised medical and surgical care services in the Kingdom.

Privatisation: The government is encouraging private sector participation with the aim of increasing it from the current 40% to 65% by 2030, targeting the privatisation of 290 hospitals and 2,300 primary healthcare centers. It is estimated that 20,000 additional beds would be required by 2035, further creating opportunities for private players to increase their investments in the sector. Remarkable about the country’s expenditure are the initiated mega project such as NEOM, the creation of a new smart planned cross-border city which provides opportunities in eHealth.

Mandatory Health Insurance: Since the implementation of mandatory health insurance, expatriates are obligated to have an insurance. Expansion of the coverage would increase utilisation of healthcare services at private facilities in the Kingdom.

Health Sector Transformation Program: In 2022, the newly established Health Sector Transformation Program as part of the Kingdom’s Vision 2030, aims to ensure the continued development of healthcare services in the Kingdom by restructuring the health sector to be a comprehensive, effective and integrated health system that is based on the principle of value-based healthcare. It aims to have 88% of the population covered by inclusive health services and the unified digital medical records systems should cover 100% of the population by 2025.

The United Arab Emirates

Demography & NCDs: The population that is slightly expanding with 1.0% in 2021. Approximately 8% of the total population is over the age of 54 years. This is expected to rise, increasing the demand for healthcare services. In addition, NCDs account for nearly 77% of all deaths, putting increasing strain on the well-being of the population, economic developments, and healthcare system. Consequently, almost 14% of the population are obese.

Mandatory Health Insurance: Following the phased implementation of compulsory medical insurance in Abu Dhabi and Dubai, the DHA has enforced insurance companies to include COVID-19 treatment under their coverage. The DHA also adopted the ‘DRG’ model (Diagnosis Related Group) that will help insurance companies categorise hospitalisation costs. This will improve business efficiency for healthcare providers.

Medical Tourism: Dubai and Abu Dhabi were ranked as the sixth and ninth most popular medical tourism destinations in the world as per Medical Tourism Index 2020-2021. Dubai hosted 350,118 medical tourists in 2019, an increase of 4.0% y-o-y, and expects the industry to contribute US$ 708 million to the GDP by 2020 with 13.0% y-o-y revenue growth. Euromonitor forecasts the UAE’s medical tourism industry to reach AED 14 billion (US$ 3.8 billion) by end of 2020 and touch AED 19 billion (US$ 5.2 billion) by 2023.

The interest of Dutch SME’s for the Gulf region is moderate. In 2019 RVO received 83 trade questions regarding the gulf region, this accounts for 1% of all registered questions.During the Research International Opportunities & Challenges 2020, 39 individual companies have indicated as being active in the UAE, Saudi Arabia and Qatar. Prominent multinationals that are active in the Gulf are Philips, Elsevier and Danone-Nutricia. When looking at Dutch knowledge institutes, for example UMC Groningen, Maastricht UMC and Erasmus MC are active in the Gulf region.

Most prominent NL value chains

The value chains of Dutch SME’s in the Gulf region is highly split-up over various strengths. There are numerous Dutch SME’s present in the region, mostly represented by distributors or local agencies.

1. The Digital Transformation of Health and Care: The application of both digital information and communication solutions to support and / or improve health and healthcare processes

- Philips and Elsevier’s tools to support clinical decision making are used by high-end health care facilities

- Spectator Video Technology and CADD Emirates signed an MOU during the economic mission to the UAE with the intent to introduce Tele-care, Tele-consult and other Telemedicine & eHealth solutions on the United Arab Emirates Healthcare market.

- Barriers: High prevalence of competition, Rule & Regulations. The high amount of expat workers means systems must be in different languages. No information transfer between the countries in the Gulf.

- Preferred region(s): UAE, Qatar and Saudi Arabia

2. Infrastructure: products and services concerning the design, building, furnishing, equipping, operations and maintenance of hospitals, clinics and health care facilities.

- Barriers: Long and complex projects. High cost of pre-investments, budgets that run out or projects that are frozen or delayed.

- Preferred region(s): UAE, Qatar and Saudi Arabia

3. Public Health: Products and services within the domains education, training, consultancy and advisory services to optimise care capacity.

4. Healthy Living & Ageing: Products and services in the field of prevention, rehabilitation and home care.

- Barriers: Complex decision making in the region.

- Preferred region(s): UAE, Qatar and Saudi Arabia

Overview milestones & flagships

- G2G (MoU, state visits)

- Trade (PIBs, Market studies)

- Innovate (joint R&D projects, specific bilateral calls)

- Invest (significant investments in the Dutch LSH sector)

Collective Activities to the Gulf Region

2015

- PIB Middle East 12-2015 – 10-2020: TFHC goes Middle East

2016

- Holland Pavilion Arab Health, Dubai

2017

- MoU between The Ministry of Economy of The UAE and the Ministry of Economic Affairs of The Netherlands, on the topic of Innovation

- Healthcare Mission, Qatar & Kuwait

- Economic Mission, Dubai & Abu Dhabi

- Holland Pavilion Arab Health, Dubai

- Holland Lounge Saudi Health

- Report: Opportunities for Dutch Businesses in the Gulf region

2018

- Healthcare Mission incl. participation GHE, Saudi Arabia

- Holland Pavilion Arab Health, Dubai

2019

- Healthcare Mission, Qatar

- Holland Pavilion Arab Health, Dubai

- Healthcare Mission incl. participation GHE, Saudi Arabia

2020

- Holland Pavilion Arab Health, Dubai

- Market Study eHealth

2021

- Health~Holland Digital Reconnect Gulf Region

- Dutch embassies in Qatar, Kuwait, UAE and KSA conducted a sector study on eHealth business opportunities in these four countries. This eHealth regional report is published on RVO’s website. eHealth in the Gulf region, phase 2 (rvo.nl)

- Organised a regional eHealth webinar in March 2021.

- Organised an eHealth webinar focusing on Qatar in June 2021 with speakers from Rotterdam eHealth Agenda, Amsterdam inbusiness, and Sidra Medicine.

- Presented the eHealth sector study during LSH010 Rotterdam Digital breakfast.

- Presented the eHealth sector study during Health Holland Digital Reconnect Gulf Region event.

2022

- Holland Pavilion Arab Health, Dubai

- Trade eHealth mission to Qatar and Saudi Arabia (May 2022)

- Export Partner, Dutch eHealth mission participants, RVO, and Dutch embassies in Qatar and Saudi Arabia discussed in November 2022 the possibility of starting a new PIB.

The way forward

During the last five years there have been numerous trade missions to Qatar, the UAE and Saudi Arabia. It is essential to keep building on the relationship and to investigate again the match between the local demand and the Dutch offerings.

Description of the activities:

- Build-on long-term collaborations and relationships: The Netherlands has an excellent relationship with the local LSH stakeholders. However due to Covid-19 the healthcare sector has temporarily shifted its focus with the result that many orders and contracts have been delayed. The Netherlands should look to reestablish and intensify collaborations in healthcare to support the Dutch SME’s.

- Strategy: Define a new strategy for the coming years, together with the Dutch LSH sector.

- Market information: Keep the Dutch LSH sector updated on developments in the different healthcare markets via webinars and specific thematic seminars.

- Collective activities: Maintain relations with the local health sector through the Health~Holland Visitors Programme, incoming and-outgoing missions and webinars.

- Explore thematic dialogues: Explore possibilities to organise specific thematic sessions to engage with local stakeholders.

- Holland Branding: Enhance the positioning and visibility of the Dutch LSH sector.