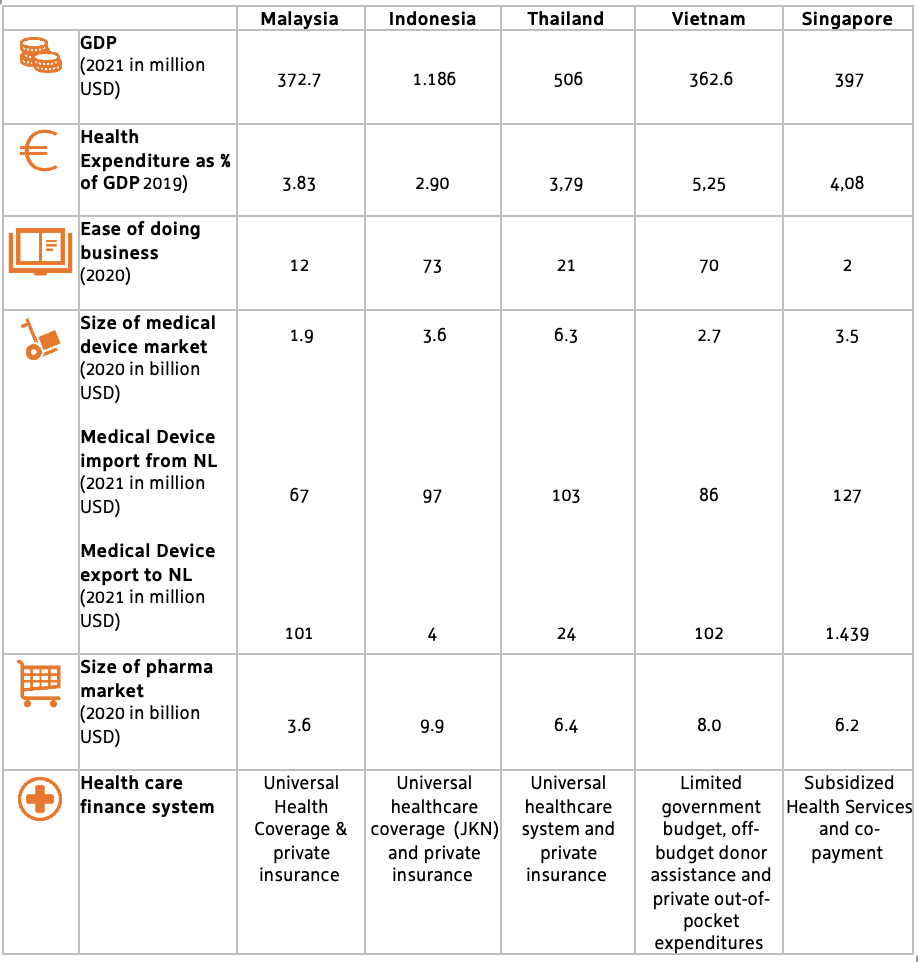

ASEAN 5 in the scope of this factsheet refers to the South East Asian nations of Malaysia, Singapore, Thailand, Vietnam and Indonesia. These five countries show strong economic growth and have strong commitments to achieve and strengthen universal health coverage. Based on the ASEAN market study (2019) there is a significant interest from the Dutch LSH sector in exporting smart solutions in the strengths 'eHealth’, 'Medical Devices’ and ‘Public Health’.

All ASEAN 5 countries are being subjected to challenges related to ageing populations, shortages of medical staff and a rising burden of non-communicable diseases. Moreover the implementation of UHC policies, a growing middle class, and medical tourism contributes to a further increase of the demand for health care. These challenges require solutions that increase the accessibility to care (mainly related to the rural areas of Vietnam, Indonesia, Malaysia and Thailand), efficiency and effectiveness of care.

All countries consider E-health as the main driver to transform healthcare in the coming year. E-health solutions can increase the efficiency, reduce unnecessary hospital visits, costs and improve access in remote areas.

The Covid-19 outbreak has accelerated the digital transformation of health care delivery models. It is also important to emphasise that a large portion of the medical devices in the ASEAN 5 countries are being imported. Therefore, a strong growth can be seen in the medical device market. From the perspective of the Netherlands the following market trends in the ASEAN 5 market are of interest:

Trade

1. Advanced devices and e-health technologies to increase the accessibility, efficiency and effectiveness of cares

· Advanced medical devices for diagnosis and treatment

· Robotics

· E-health

· Telemedicine and monitoring tools/apps

· AI and other key enabling technologies nanotechnologies, advanced materials, and advanced manufacturing and processing (production technologies) and biotechnology.

· Data infrastructure (connecting data, systems, information and persons in a convenient, safe and secure way) – Note: different stages per country with Singapore being the most advanced.

2. Healthy ageing to optimise the opportunities for physical, social and mental health of elderly people

· Promotion of healthy living

· Prevention of non-communicable and communicable diseases including screening programmes

· Rehabilitation

· Elderly care at home (to help senior people living an mobile and independent life.)

· Growing importance of mental health, even though the country does not yet have a solid infrastructure for detection, referral and treatment of mental illness and the topic is still stigmatised. Less than 1% of the health budget is spent on mental illness.

3. Health infrastructure to improve the access to health care in rural areas and increase the efficiency in urban areas

· Smart and sustainable hospitals/clinics (physical infrastructure)

· Using technologies to overcome the lack of health infrastructure in rural areas (digital infrastructure)

· Management of internal processes of care providers, including value based healthcare

Innovate

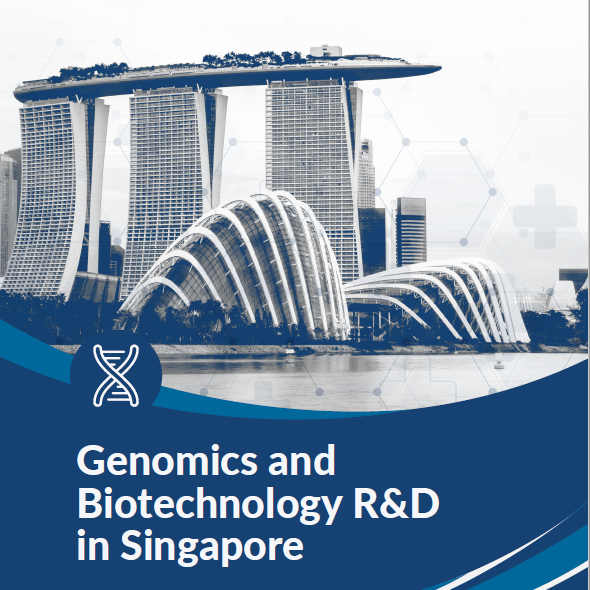

Singapore

Guided by its 5-year Research, Innovation and Enterprise (RIE) plans the National Research Foundation is investing into Singapore’s Health and Biomedical Sciences (HBS) to develop the life sciences as a pillar of Singapore’s economy and support top universities (e.g. NTU & NUS) and applied research institutes (e.g. A*STAR). Under RIE2025 the domain was expanded to include Human Potential, prioritising research projects related to population health, prevention and quality of life for the five priority diseases, and healthy ageing. R&D programmes related to future pandemic preparedness such as PREPARE are intended to strengthen Singapore’s pandemic resilience – in line with the government’s strategy to attract MNC vaccine manufacturing and research facilities (from zero pre-COVID to five in 2022).

These priorities connect well to the Dutch missions of improving access to care, decreasing disease burden and increase societal participation for chronic patients. Moreover, Singapore’s multicultural population and the goal of genetically sequencing a large portion of the population, provides interesting research opportunities for studying disease pathways. Digital health in Singapore was a priority topic before the pandemic and opportunities in this sector are diverse: tools for patient-doctor communication, remote monitoring, AI to support better and more efficient diagnostics, treatment and prevention. With data coming from various sources, such as apps, wearables, electronic medical records, and a larger role for GPs in disease prevention and screening programs, there is a need for solutions that allow secure data exchange and an accessible IT infrastructure.

Singapore and the Netherlands have a good working relationship and there is interest to collaborate together on solving national challenges. Singapore joined the EUREKA network early 2021 and SME’s from both countries can use support under Eurostars and Cluster calls for R&D collaborations.

IA-Singapore has taken up LSH as one of its priority areas. Its main focus areas are:

· Population health (e.g. primary care, GP and prevention innovation, information- and decision support technologies, screening and monitoring solutions)

· Personalised and precision medicine (e.g. pharma-, bio and MedTech)

· Dementia and healthy ageing

Health informatics, digital (health), data analytics, data sharing- and privacy-preserving technologies are viewed as a horizontal, and enabling factors, of these three focus areas.

A market report has been published last February 2022 that looks into the healthcare and R&D landscape in Singapore, MedTech R&D, genomics R&D and market entry and partnerships in Singapore.

Indonesia

COVID-19 has been a wake up call for many Indonesian officials, as it caught the country not ready with a global sized pandemic. In the beginning of the pandemic, Indonesia had to even import face masks and PPE gear. This has prompted a number of initiatives to produce local vaccines in collaboration with China, and collaboration between Universities with the private sector to produce certain medical device, such as ventilators.

Since he was elected as the Minister of Health in the midst of the pandemic, Budi Gunadi Sadikin initiated six pillars of transformation to strengthen the Indonesian healthcare system. They are transformation of the primary services, transformation of referral services, transformation of health resilience system, transformation of health financing system, transformation of human resources, and transformation of health technology system.

Indonesia's G20 Presidency also focuses on the restructuring of Global Health Architecture, to ensure global health resilience and help the global health system be more inclusive, equitable, and responsive to crises.

Indonesia and the Netherlands signed an MoU on Healthcare back in 2018, followed with a Joint Action Plan in 2019. The MoU is scheduled to be renewed in November 2023 on the sidelines of the World Local Production Forum, where the second Joint Working Group under the MoU Healthcare will be organised and hosted by Min. VWS. The new MoU will also support Indonesia’s ambition to have the ability to produce vaccines for domestic use.

NWO invests in bilateral research cooperation with Indonesia via Merian Fund. Indonesia and the Netherlands have a long history of collaboration in science, and joint fundamental and applied research programs by Indonesia and the Netherlands have been carried out for decades. Indonesia is in the top five of most promising emerging markets. Partnerships between the Netherlands and Indonesia have increasingly focused on societal challenges and include in the research, next to bilateral researchers, stakeholders from the public and private sector. The overarching theme for the Cooperation Indonesia (RISTEK-BRIN) programme is 'Resilient Societies' – including Health and quality of life.

Since 2019, the Embassy in Jakarta hosted WINNER, Week of Indonesia-Netherlands Education and Research (WINNER), together with Nuffic NESO, the Indonesian Academy of Young Scientists (ALMI), the National Research and Innovation Agency (BRIN), the Royal Netherlands Academy of Arts and Sciences (KNAW), and the Dutch Research Council (NWO).

Thailand

The Thai government launched the Genomics Thailand Initiative in 2019, aiming to establish one of the most comprehensive medical databases in the region by cataloging the genomes of 50,000 Thai people. The research will provide better understanding of Thai citizens' unique genomic complexity and serve as a foundation for developing personalised diagnostics, drug selection and treatment in the fields of cancer, infectious diseases, rare and undiagnosed diseases, non-communicable diseases and pharmacogenomic diseases. This initiative is forecast to save the country more than 70 billion Thai baht (USD 2.2 billion) in treating diabetes, HIV, acute coronary syndrome, cancer, and stroke. The long term goals are to improve its public health system and being able to provide better preventative information for Southeast Asian populations. In addition, according to the National Plan for Science, Research and Innovation, the focus areas for R&D during 2023-2027 are Vaccines, Advanced Therapy Medicinal Products (ATMPs) & Biopharma, Herbal Extracts & Medicines, Medical Devices, and Genomics.

Invest

NFIA/Invest in Holland network will not proactively work on acquisition in the LSH sector in the ASEAN 5 countries. In the event that we are approached by companies that contribute to the goal of the Netherlands in finding solutions that deliver better, affordable and sustainable healthcare and strengthen our LSH ecosystems, the NFIA/Invest in Holland network is committed to assisting them.

Singapore

Most of the Singapore companies that land in the Netherlands are under:

· Red Biotech (Healthcare): Red biotech includes producing vaccines and antibiotics, developing new drugs, molecular diagnostics techniques, regenerative therapies. One example is Cetas Healthcare.

· Medical Equipment

Singapore has a vibrant biomedical and health tech ecosystem, housing many R&D centres, start-up incubators and VCs in this field. With diversity of corporate and public HealthTech innovation partners, Singapore has created a dynamic ecosystem where talent, capital and expertise meet to pilot and scale digital healthcare and wellness solutions for Asia.

Investments have mainly been in wellness, health management solutions and medical diagnostics. In early 2021 the “Go Beyond” program was launched to support start-ups and tech enterprises from Singapore to access the Dutch market as a gateway to Europe. The program lays down a guided pathway for ventures to scale to the Netherlands and other European markets.

Last November 2022, two separate MedTech-focused delegations travelled to the Netherlands (and Germany). The first consisting of A*STAR (TNO equivalent) and SG Innovate (government-owned innovation platform to support deep tech entrepreneurship) focused on exploring collaboration with Dutch product design houses/contract manufacturers, exploring relations for collaboration, licensing, investment, incubation and understanding emerging trends and models for ecosystem building, and translation. The second was organised by Enterprise Singapore (RVO equivalent) and consisted of various Singaporean MedTech start-ups and hospital innovation offices. The aim was to better understand the Dutch market and opportunities as gateway to the rest of the European market.

Malaysia

For 2021, there has been number of interests from Malaysian companies/investors in considering the Netherlands as their next place of operation. For LSH in particular, we received couple of requests especially in the area of:

· Clinical R&D

· Biotech

· Medical devices

Regional priorities

Indonesia

The total healthcare budget for 2023 is declined by 16.1% y-o-y compared to the previous year, due to improved COVID-19 situation, however, when compared to the regular (non-Covid) budget, the amount is increased by 36.9% y-o-y. The Government aims to allocate 5% of the total annual state budget on healthcare, which shows the Government serious commitments on Indonesia’s healthcare system.

Changes on the regulatory framework of the Indonesian Universal Health Coverage, i.e., an increase of the INA CBG and a refined Coordination of Benefit scheme, and the new e-procurement catalogue system, paint a favourable picture for private hospitals. Overall increase of the INA CBG resulting in potential upsides on earnings, whilst the CoB scheme enables hospitals to earn more from patients wishing to top up with private insurance coverage. The new e-procurement system benefits hospitals by providing them abundant options and the freedom to choose based on their requirements. Three hospital groups are expected to enjoy the changes, Siloam Hermina, and Mitra Keluarga.

A new challenge in Indonesia, especially in the medical device market is the requirements for local contents. In June 2021, Indonesia introduced a new regulation requiring 40% local content of over 5,400 medical device products in 79 categories from the e-Katalog public procurement system used by Government’s hospitals and clinics.

Singapore

Last October 2022, Singapore’s government announced it will be introducing a major reform to its healthcare system under Healthier SG – a strategy focused on preventive care to tackle the challenges related to its ageing population, and the rising burden related to chronic diseases. Singaporeans who choose to enrol in Healthier SG, a voluntary program, will benefit from several benefits. Some of its key features include:

1. Registration and pairing with a fixed family doctor, which would allow doctors and GPs to monitor and plan for the patient’s health over time;

2. Free screening programs, vaccinations and health checks for certain types of cancers and common chronic conditions;

3. Treatment of chronic illnesses can be completely reimbursed by the patient’s personal medical savings account, which waives the general 15% co-payment principle;

4. Additional subsidies and discounts on drugs and medicine;

5. Introduction of various technology enables, allowing citizens to use apps to collect points and earn discounts.

Besides focusing on prevention and promoting a healthy lifestyle, digitalisation is one of the pillars to help safeguard effective care in the future. Under Singapore’s Smart Nation Initiative, health is one of the focus areas.

New market opportunities might emerge in the field of digitalisation and innovation. Singapore looks at technologies that facilitate telemedicine, telemonitoring, personal health management and prevention. Examples are home monitoring for the elderly or patients after a surgery and apps or wearables to improve healthy living. In addition, robotics and assistive technologies such as artificial intelligence and augmented reality are used, e.g. data analytics to improve daily operations in hospitals and in diagnostics and treatment. Personalised medicine is another promising area, as Singapore is building a genetic biobank as part of its National Precision medicine program, and is home to many pharmaceutical MNCs.

Malaysia

Malaysia’s current focus is ensuring the healthcare system remains effective in tackling the Covid situation including alternative care models beyond the traditional settings. Because of Covid-19 there is an accelerated adoption of innovative projects by hospitals including telemedicine services, decentralisation of care and FMR systems. There is also a renewed recognition and emphasis on investing in capacity building, improved diagnostics & supply chain management solutions. At USD 1.4 billion annually, Malaysia is the second largest market for medical devices of 4 ASEAN countries, it is expected that there will be a jump in demand for a diversity of medical devices particularly those that increase operational efficiencies in primary care, diagnostics, EMR, aged care and supply chain management.

Moving forward, the management of Non-Communicable Diseases (NCDs) such as diabetes and hypertension would be high in the agenda. The government will also look into the construction of new health facilities particularly in rural areas to cope with the pandemic. Malaysia has recently announced its readiness to become a hepatitis C treatment hub in the region. The revival of medical tourism travel plays a key role in the healthcare ecosystem and further would further drive the demand for medical devices and private healthcare facilities

Thailand

Thailand’s medical device sector is one of the most well-known sectors in the region. The country is ranked first and second in terms of medical device exports and imports among ASEAN countries. In 2020, the medical device market was estimated to reach USD 6 billion. The country’s domestic production was valued at USD 7.8 billion, out of which it imported medical devices worth 1.7 billion USD. The country forecasts that the market will grow steadily at 6.5% in 2022-2023. Aiming to remain the medical hub in the region, the Thai government has provided investment incentives in the medical device sector and in research activities in medical robotics for manufacturers of advanced medical equipment that includes robotics software and hardware.

Moreover, over the past few years, Thailand is adapting to the new environment by utilising digital technology to expand and improve telemedicine services as well as to drive medical investment and innovation to the next level. The issuance of Telemedicine Guidelines has created rapid developments on the legal and regulatory, including the progress of Thailand’s digital transformation. For example, patients can access consultations with doctors from a distance for follow-up purposes, pharmacists are able to dispense general and household drugs without seeing patients in person. In addition, the government is encouraging public and private hospitals to focus on digitalisation to help speed up medical service processes and keep a high standard of care as well as to become smart hospitals. As a consequence, many hospitals and health care facilities in Thailand now apply more E-health technologies such as medical robotics, software and telemedicine. Demand driven factors are rising cases of NCD’s (for instance, heart disease, stroke, cancer and diabetes) and the ageing population. However, the implementation and development of E-health, telemedicine, including smart hospitals in the country is still in its early stages. Tech and medical healthcare services vendors can play a role in providing the technology for Thai hospitals.

Vietnam

Vietnam’s ageing population, the emerging middle and affluent class, and the increasing burden of chronic diseases reflect some of Vietnam’s societal shifts in the healthcare sector. These trends are increasing the demand for transformative, accessible, long-term care. Due to this, Vietnam’s medical device market is one of the fastest growing in Asia. The best business opportunities for medical devices and equipment in Vietnam are those related to cardiovascular, cancer, diabetes, radiotherapy equipment, neurosurgical devices, operating theatre equipment, sterilising and infection control devices, imaging diagnostic devices (e.g. for viral infections and diabetes), orthopaedic implants and related devices, lab instrument and devices. The use of telecommunication and information technologies in order to provide clinical health care at a distance could also be an interesting area.

In order to collectively deliver consumer-centred care, in the most efficient way, local hospitals (both public and private) are open to partnering with foreign hospitals and well-established brands. Exchanging expertise, and working together will be able to beneficially diversify their range and mode of providing services.

The Dutch interest in the ASEAN 5 countries is still considerable. Between 2019 and 2021 RVO received 238 ASEAN related requests. This is significantly lower compared to the 500 requests received between 2018 and 2019. A possible explanation is the Covid-19 pandemic starting in early 2020. Because of the travel restrictions many Dutch LSH companies reduced their international activities and/or gave priority to more nearby markets. The majority of Dutch organisations active in ASEAN 5 can still be found in the category of small and medium sized businesses.

Prominent multinationals that are active in the region are Philips, Elsevier and Danone-Nutricia. When looking at Dutch knowledge institutes all university medical centers are collaborating on research and/or education with their counterparts in Indonesia and Singapore.

Most prominent NL value chains

The most prominent value chains for the ASEAN-5 market are Medical devices, E-health and Infrastructure solutions that ensure more efficient and more accessible care. The accessibility of care concerns both the provision of care solutions in rural areas and solutions that contribute to the longer independent living of the elderly at home.

1. The digital transformation of health and care: The application of both digital information and communication solutions to support and / or improve health and healthcare processes. In ASEAN-5 context, specifically E-health and Artificial Intelligence.

demonstrated (or expected) impact and activities:

> Philips and Elsevier’s tools to support clinical decision making are used by high-end health care facilities

> Delft Imaging is using its Computer-Aided Detection for Tuberculosis (CAD4TB) in the prisons of Jakarta an din the mining industry.

· Potential opportunities: Telemedicine considered as a promising solution, to increase quality, efficiency and effectiveness but also to improve access to healthcare in rural areas and facilitate elderly care and self-management at home.

· Barriers: different stages of data-maturity per country, requires knowledge about the privacy and data protection laws and regulations.

· Preferred region(s): Singapore, Malaysia, Thailand, Indonesia and Vietnam.

2. Accessible medical technology for sustainable health and care: instruments, appliances and materials that impact the delivery of health services and processes within a healthcare provider.

· Demonstrated (or expected) impact and activities

> LifeSense Group (wearable technology to combat urinary incontinence) has signed contracts with partners in multiple ASEAN countries.

> Demcon a supplier of contract research and advanced medical systems (including ventilation) established an Asian subsidiary in Singapore in 2019 focusing on supporting R&D for medtech OEMs and contract manufacturers based in Singapore.

> Sioux Technologies supports high-tech medical OEMs with integration, assembly, testing and delivery of modules and applications from concept to market launch, data analysis and system engineering, established an Asian subsidiary in Singapore in 2019 to service the automotive, medtech, semicon and agrifood sector.

· Potential opportunities

> growing private sector, demand for quality brands and preference for quality over costs

· Barriers: lack of transparency (Indonesia), strong competition and small market (Singapore), low reimbursement public sector (Malaysia, Thailand and Vietnam, Indonesia) strengths of Dutch LSH sector not well known in Malaysia, Thailand and Vietnam.

· Preferred region(s): Malaysia, Thailand, Indonesia, Singapore & Vietnam.

3. Infrastructure: products and services concerning the design, building, furnishing, equipping, operations and maintenance of hospitals, clinics and health care facilities. In ASEAN-5 context, specifically hospital build.

· Demonstrated (or expected) impact and activities:

> Hospitainer has signed a MoU with Desa Emas. Together they will work on a plan for 3 pilots in the coming two years. One clinic in the ground, One clinic on wheels and One clinic on a vessel.

> Telecom has implemented medical pneumatic tube systems in several Thai hospitals.

· Potential opportunities: health infrastructure in remote areas and a cluster approach (including financing) to look at opportunities for Hospital development under a PPP scheme.

· Barriers: Long and complex projects.

· Preferred region(s): Malaysia, Thailand, Indonesia and Vietnam.

Overview milestones & flagships

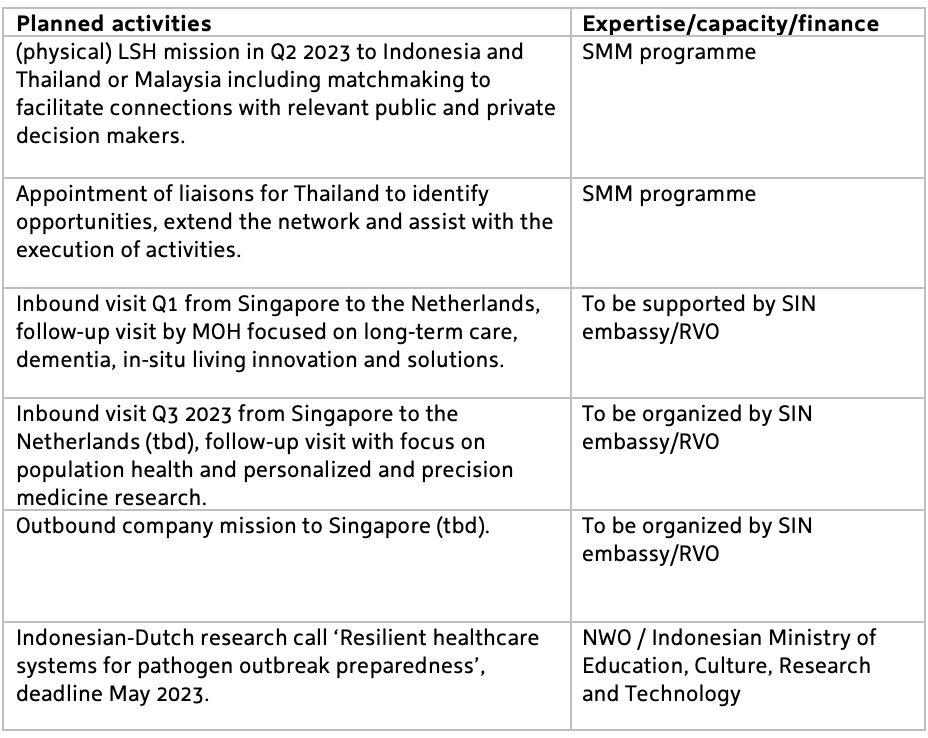

Collective Activities to ASEAN 5

During the last five years three large trade missions to Indonesia took place with Prime Minister Rutte, Minister Bruins, and the royal couple. In 2016 Singapore was visited as well. With regard to the other countries only smaller trade and/or innovation missions without government officials have been organised.

2018

· Trade mission to Indonesia with Minister Dekker

· MoU Healthcare signed on November 2018 in Bali. Implementation plan agreed on Apr 2019 in Geneva. Last Joint Working Group on March 2020.

2019

· ASEAN Market Study covering Malaysia, Thailand, Singapore and Vietnam

· LSH mission to Thailand & Malaysia

· LSH Mission to Indonesia, Hospital Expo

· First Global Stars Call Singapore and EUREKA countries

2020

· Trade mission to Indonesia with the royal couple

· Second Global Stars Call Singapore and EUREKA countries

2021

· Launch of Strategic Multi-Annual Market Approach (SMM) Connected Care (June)

· Virtual LSH mission to Indonesia, Thailand and Malaysia (June-July)

· Launch of Market study (SMM) Indonesia (September)

· Appointment of liaison (SMM) for Indonesia (November)

· Meet & Greet with liaison for Indonesia (SMM) (November)

· Virtual expert sessions during the Singapore / Netherlands Digital Health week (November)

2022

· Market study on healthcare and R&D landscape (incl. MedTech and genomics) in Singapore (February)

· LSH mission (SMM) to Indonesia & Malaysia (June)

· Visit by the Minister of Health, Welfare & Sports in combination with Innovation mission Dementia to Singapore (October 24-28)

· G20 Bali Summit (November)

· LSH mission (SMM) from Indonesia, Malaysia and Thailand to the Netherlands (November)

· Incoming MedTech-focused delegation from Singapore to Netherland (and Germany), 1st A*STAR and SG Innovate, 2nd Enterprise Singapore delegation. The aim was to better understand the Dutch market and opportunities as gateway to the rest of the European market.

· In October 2022, an Innovation mission to Singapore around personalised approach to Dementia prevention, treatment and care took place. The dutch delegation consisted of different representatives from the LSH sector including the Minister of Health.

During the last six years three large trade missions to Indonesia took place with Prime Minister Rutte, Minister Dekker, and the royal couple. In 2016 Singapore was visited as well and in 2022 by Minister VWS Ernst Kuipers. With regard to the other countries only smaller trade and/or innovation missions without government officials have been organised.

The way forward

· To keep: Small scale trade and innovation missions.

· To strengthen and deepen

> Trade missions with government officials (until now mainly focused on Indonesia)

> Enhance the positioning and visibility of the Dutch LSH sector

> Strengthen the connections with Key Decision-Makers

> Provide the LSH stakeholders with more insight into connections with financing programs for projects in the target market: both national (RVO) and international (ABD/WB)

> Get more insight in the success and failure factors of Dutch LSH companies that are already active in the region

> Collect more in-depth market entree knowledge for specific subsectors: registration of medical software (Indonesia)

> Strengthen collaborations between universities in NL with universities in ASEAN5

> In Singapore the focus will be on innovation within LSH.

· (New) activities: