Colombia is Latin America’s fastest growing and most stable economy; COVID has had a huge impact, but not as much as on other countries in the region. The Colombian health system has been named the best in Latin America and is ranked 22 worldwide by the WHO.

Colombia is a country of contrasts, while in the largest cities one can receive a very high standard care, in rural and remote areas the provision of quality healthcare is lagging. The country is working on strategies to close the gap, facing challenges such as efficiency, financial sustainability, and addressing those factors that cause pressure within the system. The impact of an ageing society and the subsequent increase in non-communicable diseases are examples of some of the pressures. Colombian healthcare stakeholders are eager to interact with the Dutch, with many of them looking to the Netherlands as one of the top reference countries. This combination leads to opportunities to provide highly innovative healthcare solutions, which has resulted in the establishment of the Partners for International Business (PIB) WeCareColombia developing initiatives that contribute to improved public health.

The most recent and important developments in Colombia’s healthcare sector include the reformulation of the Ten Year Health Plan (2022-2031), a pending Health Reform which will be submitted by the newly appointed government and the increased attention for financial sustainability.

· The priorities of the health sector and the dynamics of public health in Colombia are guided by the Ten Year Health Plan. The Ten Year Public Health Plan is a public policy that includes the roadmap that establishes the objectives, goals and strategies to face the challenges for communicable and non-communicable diseases for public health in the next 10 years. One of the key objectives of the plan is to accomplish a differential approach including those with more vulnerable conditions and in particular indigenous population. Priority topics to be highlighted are: the strengthening of primary health attention, early detection of chronic diseases, and specific goals for 15 types of cancer, AMR is mentioned under the approach of one health, mental health, and health provision in dispersed and remote territories making use of extramural units. There is also focus on digital health and interoperability and strengthening of knowledge and development of human talent.

The upcoming Health Reform is aiming to guarantee access to healthcare by creating a unique, public, universal, preventive, predictive, participatory, decentralised and intercultural system. This new proposal could mean a new structure within the system that will be discussed during the first quarter of 2023.

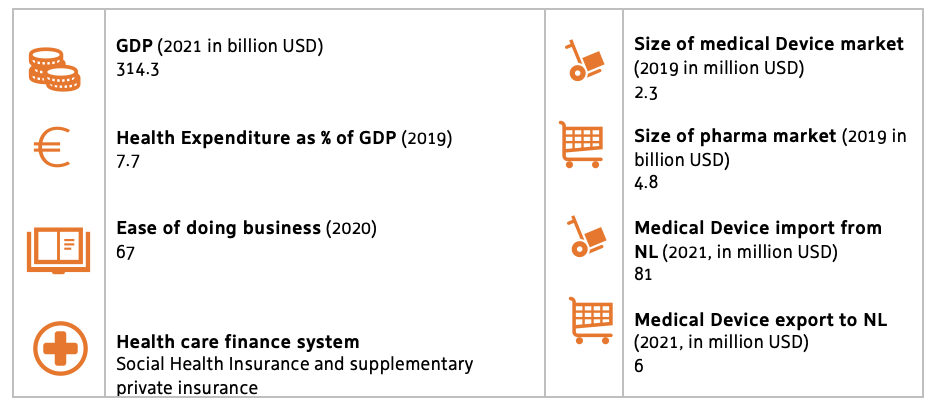

Trade

Colombia’s major investments in its health sector provide numerous opportunities for the Dutch LSH-sector. Prominent investment is planned aiming to improve sustainability and quality of health services and aiming to close the gaps between urban and rural areas.

These investments and developments may result in an increase in the purchasing of innovate medical solutions in the public sector in the coming years:

- The Digital transformation of Health and Care: The use of digital solutions, such as telemedicine, e-health, big data, electronic health records and value based health care, are becoming more prevalent in Colombia. Two main trends can be distinguished: 1) the use of technology to provide remote care, 2) the unification of data systems for the effective use of available data to provide ‘outcome based care’.

- Healthy Living & Ageing: Colombia’s population has been steadily ageing for several decades. The % of Colombians over 60 will rise to 20.9% by 2050. Currently, home care, day care and residential care are fragmented and there is room for development. The National Government has set priorities including strengthening the quality of life and improving health status in the course of life, especially at high age and increasing quality and infrastructure of care provision to the elderly. Colombia seeks knowledge from experienced countries in terms of policy-making and different forms of care provision in order to deal with the challenges of a rapidly aging population.

- Public Health: The Ministry of Health has prioritised non-communicable diseases, human talent and increasing quality, therapeutic values and cost effectiveness as key issues for the coming years. Colombia is looking abroad for solutions related to prevention, screening, treatment, remote training and education.

Research & innovation

Currently R&D collaborations between the Netherlands and Colombia have yet to be identified. Nevertheless, the 2020 emergency has led to add on top of the Colombian agenda: pharmaceutical security, advance therapies (drugs and medical devices) and bio products, which could offer opportunities for collaboration.

The sustained growth of the Colombian pharmaceutical industry with a CAGR of 7% in local currency potentially offers opportunities for R&D collaboration.

The pharmaceutical sector is key in the process of strengthening the Colombian health system. The national market is an excellent option to invest in clinical studies.

Invest

The Netherlands Foreign Investment Agency (NFIA/Invest in Holland network) doesn’t have a local office in Colombia.. The Invest in Holland network will not proactively work on acquisition in the LSH sector in Colombia. Reactively, Invest in Holland is keen to welcome and assist foreign companies that contribute to the goal of the Netherlands in finding solutions that deliver better, affordable and sustainable healthcare and strengthen our Life Sciences & health ecosystems.

Regional priorities

Urban

20% of the healthcare system affiliates are located in Bogotá-region, followed by the states of Antioquia, including its capital Medellin, with 13% and Valle, with the capital Cali, with 9%. Bogotá represents 75% of the sales of medical devices.

The presence of Colombian institutions continues to stand out in the America Economia’s 2021 ranking, where two are within the five best and five within the ten best in the region and a total of 26 Colombian institutions out of 61 from all of Latin America are present, corresponding to 42.6% of the total. A matter of fact, Colombia is the reference country to provide complex treatments to patients from the Caribbean parts of the Kingdom.

The Pharmaceutical market also concentrates in Bogotá, where 66% of the manufacturers and 65% of the wholesalers are located representing 49% of the sector´s jobs. In addition, it is the main commercial hub of the industry with 47% of the exports and 82% of the imports. Urban centers such as Medellín, Barraquilla, Cali and Bucaramanga have a similar healthcare landscape as Bogotá.

Rural

Health services in rural areas in Colombia are developing fast as the Colombian Government designed the National Rural Health Plan (PSNR) after signing the Peace Treaty with the FARC in 2016. The PNSR stretches over 15 years and is financed by both the Colombian government and foreign donors.

As central agenda topic in the formulation of the new public health plan is meeting the needs of the population based on a territorial component and the territorialisation of health.

Overview milestones & flagships

- G2G (MoU, state visit)

- Trade (PIBs, Market studies)

Collective Activities to Colombia 2015 – 2022

2015

- Visit Minister of Health Schippers: Signing of the Work Plan for the Complementary Health Cooperation Agreement initiated in 2006.

2016

- Holland Pavilion on trade fair Meditech in Bogotá – 16 Dutch companies & organisations, of which 60% still active (through distributors or projects) in Colombia.

- RVO TFHC Market survey LSH Colombia.

2017

- Life Sciences & Health Roadshow through Colombia (Bogotá, Medellín, Bucaramanga, 10 participants), of which the NL Works pilot project with “Healthy Villages” is a direct result, as well as the telemedicine projects of Spectator and pneumatic tube system projects in hospitals of Telecom Tube Systems.

2018

- Economic mission led by PM Rutte and SG Gerritsen (Bogotá & Calí) with 26 Dutch LSH companies.

- Signing Renewed Work Plan by Dutch & Colombian Ministries of Health.

2019

- RVO TFHC Market Study LSH Colombia.

- Oncology and Palliative Care Missions.

- “Healthy Villages” pilot in the remote area of Guainía.

2020

- Outgoing digital showcase as replacement of the physical expo and visit of the OES (Organización para la Excelencia de la Salud) International Forum in Cartagena that was scheduled for May 2020.

- Incoming mission Elderly Care Compensar.

2021

- PIB WeCareColombia has been signed in May 2021. This public-private partnership aims to improve the structural collaboration working towards integrated healthcare in Colombia.

- Knowledge exchange Human Talent – Nurses.

- Knowledge exchange Oncology.

- Alliance between Holland House Colombia and Compensar (HMO).

2022

- PIB WeCareColombia outgoing LSH mission to Bogotá and Cali, including matchmaking activities

- Outgoing digital matchmaking, as follow-up on the LSH mission, for the PIB WeCareColombia

- Fact finding study on AMR was started, CO-ACTION project.

- H~H Digital Meet-up LATAM

The way forward

When it comes to the future LSH collaboration between the Netherlands and Colombia the ambition has been set to maintain and further grow the role of the Netherlands as one of the top reference countries to Colombia and grow the already sisable number of concrete collaborations. To proceed we suggest performing actions on a number of high-potential themes:

Preferred actions

- Build-on long-term collaborations: The Colombian and Dutch Ministries of Health signed a Renewed Work Plan for the Complementary Health Cooperation Agreement in 2018, spurring collaborations in healthcare. The Netherlands is working on reestablishing and intensifying collaborations at the G2G, G2K and K2K levels.

- Position the Netherlands in Colombia: The Netherlands LSH sector is positioned as a key partner in those areas of interest for both countries.

- Explore and grow collaborations: There are great challenges within the Colombian health system to respond to the emerging needs in chronic diseases. The challenge for the country is focus on integral attention and quality. The concentration of services is within the main cities with great needs within the territories.

- Market information: keep the Dutch LSH sector updated on developments in the Colombian health system.

- Collective activities: Maintain relations with the Colombian health sector through the Health~Holland Visitors Programme, incoming and outgoing missions, thematic dialogues and webinars.