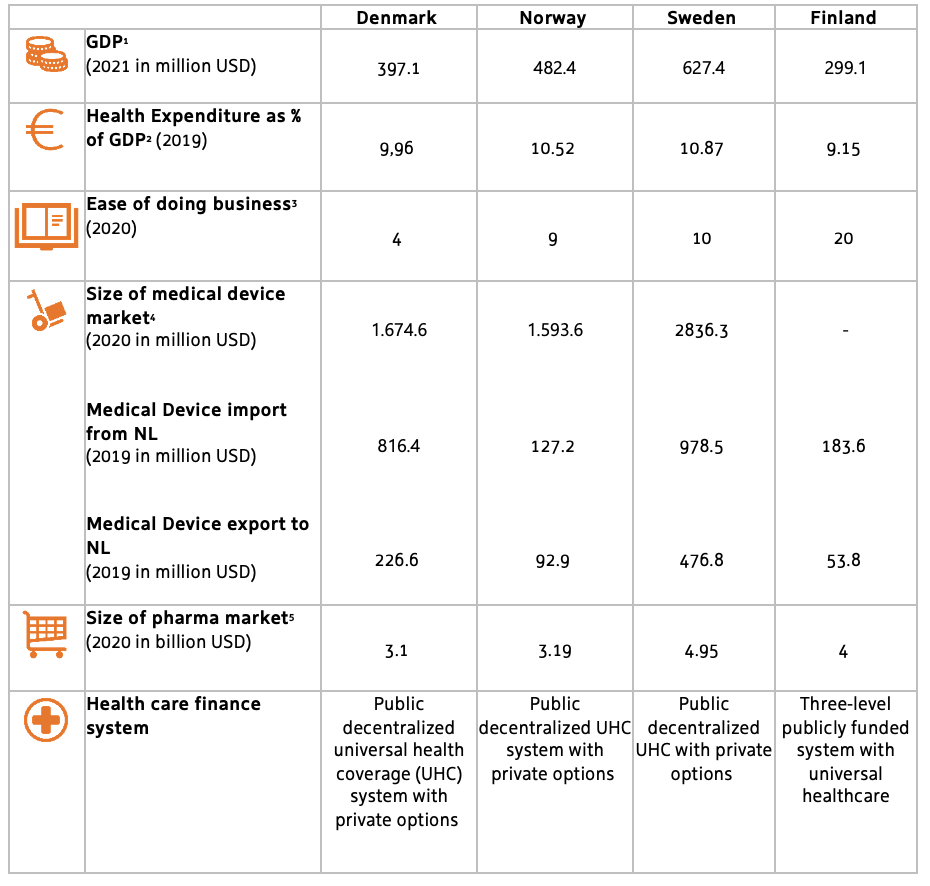

The Nordics in the scope of this factsheet refers to Denmark, Norway, Sweden and Finland. These four countries show strong economic growth and offers an open and innovative LSH ecosystem with many business opportunities. Based on the performed market studies (2021/2022), there is a significant interest from the Dutch LSH sector in exporting innovative solutions in the strengths of ‘eHealth’, ‘MedTech’, ‘Healthy Ageing’ and ‘Sustainability’.

From the perspective of the Netherlands the following market trends are of interest:

Trade

1. Digitalisation of healthcare (eHealth): Nordic countries are increasingly making their hospitals future-proof, which entails the number of beds for inpatient treatment will decrease and digital outpatients visits will increase. Therefore, there is interest in new digital solutions. There is also worked towards more interoperability and connectivity between different levels of healthcare.

2. Ageing Population: all four countries face increased pressure on their healthcare systems as the population is ageing. Assistive devices in the personal living environment rose in popularity and implementation, in order to let elderly live (semi-)independently for as long as possible.

3. Decentralisation of healthcare (homecare): there is an increased interest from Nordic countries in Dutch elderly homecare solutions to manage an growing elderly population and a shortage of caregivers. There are several programs operated in the Nordics that focus on new living concepts involving the elderly population in the country.

4. Mental health & prevention: in relation to elderly care, there is a focus on dementia research and care. Besides, there is an increased interesting in prevention and business models for preventive tools.

5. Precision healthcare: the generic pharmaceuticals market has grown significantly and there is an increased interest in precision medicine in all three countries. In Norway for example, a national strategy for personalised medicine is in place.

6. Sustainable hospital build: all Nordic countries are involved with the green transitioning of their hospitals. Sustainability impact is a good selling point in the sector of hospital design and build and provides opportunities for Dutch companies.

Research & innovation

Currently, Health~Holland does not yet have a strategic or thematic approach for Dutch-Nordic R&D collaborations. We do see a significant amount of international R&D cooperation projects between the Netherlands and Nordic countries with applications in the health and care market. In EUROSTARS alone, we have seen around 100 R&D project collaborations with SMEs since 2008. Denmark and Sweden are in the top 5 of SME R&D partner countries (after Germany, Switzerland and UK). EUROSTARS is an important instrument for SME R&D collaborations with Nordic countries. This programme makes it possible to apply for funding for bilateral or multilateral research and innovation projects.

Netherlands Enterprise Agency could be a valuable entrance point for companies and consortia with research and innovation ambitions with Nordic partners. Because of it’s role as member of EUREKA network and national contact point for Horizon Europe and EU4Health, Netherlands Enterprise Agency has warm relations with the government agencies in Denmark (Innovation Fund Denmark), Finland (Business Finland), Norway (Research Council of Norway) and Sweden (Vinnova). We have a counselor for science, innovation and technology at the Dutch embassy in Stockholm, Sweden. These connections can be used for matchmaking and discuss support opportunities.

Invest

Although the Netherlands Foreign Investment Agency (NFIA/Invest in Holland) does not have a local office in the Nordics this area becomes more and more of an interest. Support can be offered through the Invest in Holland Life Sciences & Health team or the German Office.

NFIA /Invest in Holland network is keen to welcome and assist foreign companies that contribute to the goal of the Netherlands in finding solutions that deliver better, affordable and sustainable healthcare and strengthen our Life Sciences & health ecosystems. Additionally, for the Nordic countries, the Netherlands can provide an easy step into the larger European markets.

Regional priorities

Denmark

Regional priorities are not limited to a specific region. Copenhagen and its surroundings (e.g. Swedish Malmö) is an opportunity as it is the biggest urban area. Medicon Valley Alliance in the greater Copenhagen region is one of the largest life science cluster in the Nordics.

Norway

Regional priorities are not limited to a specific region. Oslo and its surroundings is an opportunity as it is the biggest urban area. A major regional challenge in the system is the provision of services for the rural population in Norway. There are demands for digital tools this group can access, including tools of self-management for chronic patients.

Sweden

Regional priorities are not limited to a specific region. Stockholm and its surroundings (e.g. Uppsala) and Gothenborg are opportunities as it are the biggest urban areas. Sweden has strong centres for life science innovation in the Stockholm/Uppsala region, Gothenburg, the Skåne region, Umeå and Karlskoga-Örebro. Medicon Valley, spanning the Greater Copenhagen region of eastern Denmark and southern Sweden, is an international leading hub for the LSH sector.

Finland

Regional priorities are not limited to a specific region. Helsinki and its surroundings is an opportunity as it is the biggest urban area. Most LSH activities in Finland are concentrated around the five special responsibility areas of Helsinki, Oulu, Turku, Tampere and Kuopio. By 2023, the Finnish healthcare system will have undergone a fundamental change under the Sote reform, where the responsibility for organising and funding healthcare services will shift from the municipalities towards 21 larger autonomous regional authorities. Consequently, this offers many new opportunities for Dutch companies.

- The Digital Transformation of Health and Care: Dutch organisations that develop and deliver IT solutions for Health Information Management Systems, Resource and patient flow, Health Financing, Health Behavior & Prevention, Telehealth & Mobile Health (health from a distance), Disease management platforms, Electronic Health Records, Training & Education, and artificial intelligence to support medical decision-making. The largest subsection of the Dutch healthcare sector is active in this value chain.

- Potential opportunities: large commitment towards - and developments in - digital health in the Nordic region.

- Barriers: finding a good distributor; language & cultural differences; knowledge on market entry; reaching key decision makers

- Preferred region(s): not limited to specific regions as certain solutions are meant for areas where healthcare is less easily accessible and other where healthcare delivery coalesces.

- Healthy Living & Ageing: Products and services in the field of healthy aging, healthy living, prevention, elderly care, rehabilitation and home care.

- Potential opportunities: As with most developed nations, the Nordic region has an increasingly aging population. This bring about challenges for the healthcare system but also provides opportunities to work with novel and innovative solutions, systems and healthcare delivery models in order to improve prevention, keep people active and engaged as long as possible, facilitate living at home for as long as possible.

- Barriers: finding a good distributor; language & cultural differences; knowledge on market entry; reaching key decision makers

- Preferred region(s): not limited to specific regions as certain solutions are meant for urban environments and others are designated for areas where the care is further removed from the people.

- Public Health: new concept and models to change the paradigm of healthcare like value-based healthcare, prevention, and new concepts to improve the lives of seniors and promote healthy aging. Furthermore, training and preparing both healthcare professionals as well as patients/citizens to use innovative tools and systems in a manner that unlocks their full potential.

- Potential opportunities: see above for aging community; increasing complexity in healthcare and the use of new and novel technology and tools.

- Barriers: language & cultural differences; knowledge on market entry; reaching key decision makers.

- Preferred region(s): not limited to specific regions.

- Accessible Medical Technology for Sustainable Health and Care: Dutch organisations that produce, assemble and deliver medical devices, supplies and/or supply packages (medical kits) for diagnostics, treatments and/or rehabilitation.

- Potential opportunities: the Nordic region is highly reliable on medical device imports

- Barriers: finding a good distributor; knowledge on market entry.

- Preferred region(s): larger urban areas where main industry is present.

- Infrastructure: products and services concerning the design, building, furnishing, equipping, operations and maintenance of hospitals, clinics and health care facilities.

- Potential opportunities: hospitals need to be made future proof and need to be renovated as most were built in the late 20th century. Furthermore, timelines for green field hospitals and renovations run in the decades. With a rapidly changing healthcare system, there is a need to think about what the future function of a hospital is in the system and what kind of functionality is needed in that future. This requires a different way of looking at designing, building and outfitting hospitals - a process which has been going on in the Netherlands for some time and with considerable progress.

- Barriers: local competition and lack of a wide and deep enough network.

- Preferred region(s): not limited to specific regions, based on hospital (renovation) projects.

Overview milestones & flagships

- G2G (MoU, state visits)

- Trade (PIBs, Market studies, missions, trade fairs)

- Innovate (joint R&D projects, specific bilateral calls)

- Invest (significant investments in the Dutch LSH sector)

Collective activities to the Nordics

2017

- Market Studies on Denmark, Norway and Sweden

- Launch event market studies

2018

- Roadshow mission to Denmark, Norway and Sweden

- Incoming delegation from Scandinavia during Health~Holland Visitors programme and World of Health Care

2019

- Incoming delegation from Scandinavia during Health~Holland Visitors programme and World of Health Care

2020

- (cancelled) participation at Vitalis Trade fair & Congress

- Incoming delegation from Scandinavia during Health~Holland Visitors programme and World of Health Care

2021

- Update market studies on Denmark, Norway and Sweden;

- Market studies for the Baltics

- Launch event for updated studies

- Launch event for market studies Baltics

- Trade mission to the Scandinavian region

2022

- Market study Finland

- Launch event for market study Finland

- H~H Digital Meet-Up Nordics

- Incoming delegation from Scandinavia during Health~Holland Visitors Program and World of Health Care

2023

- Trade mission to Denmark & Sweden

The way forward

The Nordic region has been designated a category 2 priority region in the Health~Holland International Strategy 2020-2023. This is indicative for the specific interests that exist for the Nordic region from the Dutch LSH sector. Based on this, the goal is to strengthen and deepen the relations with the Nordic region, explore new venues for collaboration specifically focused on the themes mentioned above and to maintain the already present contacts and partners in this region. In concrete terms, this will require identifying potential collaboration partners in the region which are open for long term cooperation (potentially through MoU’s), further clarification on the (business) opportunities in the Nordics and activities to facilitate and promote interaction on various levels and on differing themes. Furthermore, it will require improving the familiarity of Nordic healthcare stakeholders and leaders with the Dutch LSH ecosystem. Lastly, in order to promote long-term and sustainable relations with the Nordic region, the pool of Dutch organisations interested in the region should be further expanded.

(Preferred) actions

- Collecting Market information: By conducting and updating market studies we expect to gain comprehensive insights in the healthcare systems in the region; trade and collaboration opportunities for the Dutch LSH sector; funding opportunities and areas that are most fruitful for cooperation and deserving of continued attention. The need for these studies was validated by feedback from the sector, who mentioned market insight and updates as well as an overview of funding opportunities as a much needed tool for them to be successful in the Nordic region.

- Activities: The Dutch LSH sector has mentioned finding suitable distributors as a barrier to doing business in the Nordics. Hence, matchmaking is considered a worthwhile activity to develop in order to promote trade.

- Activities: The difficulty of getting in touch with key stakeholders was mentioned as an entry barrier for several companies. Therefore, a trade mission is seen as the right tool to increase exposure to such individuals.

- Activities: In order to increase awareness on the opportunities in the Nordic healthcare market among Dutch stakeholders, the market studies will be launched in publicly available (digital) sessions.

- Activities: Promote Nordic awareness of the innovate and high quality Dutch LSH sector and system through incoming delegations to the Netherlands through events like the Health~ Holland Visitors Programme and the World of Health Care.

- Activities: Vitalis Trade Fair in May in Göthenburg.

- Cooperation between Dutch stakeholders: Segment the Dutch LSH-sector in specific themes/USPs, companies can be distributed along these different segments. Per segment, a strategy is proposed that aims at gauging the potential interest in a (pre-)PIB/PPS among Dutch organisations.

- Dutch representation in the Nordics.

Market study 2021 - Matching Dutch Solutions to Nordic Challenges for Future-Proof Healthcare

Market study 2021 - Matching Dutch Solutions to Nordic Challenges for Future-Proof Healthcare

Market study 2021 - Matching Dutch Solutions to Nordic Challenges for Future-Proof Healthcare